Purchasing a food franchise is a dream many entrepreneurs pursue, offering an established brand, proven business model, and built-in customer base. But before you dive headfirst into owning a successful franchise, the big question arises: How do you finance the purchase of a food franchise? While the potential for success is significant, so are the costs. Understanding how to finance a franchise purchase effectively can be the key to making your business dreams a reality.

In this guide, we’ll break down the different financing options available, including bank loans, SBA loans, franchisor financing, and alternative funding routes. We’ll also touch on real statistics and offer practical advice to help you navigate the financial landscape.

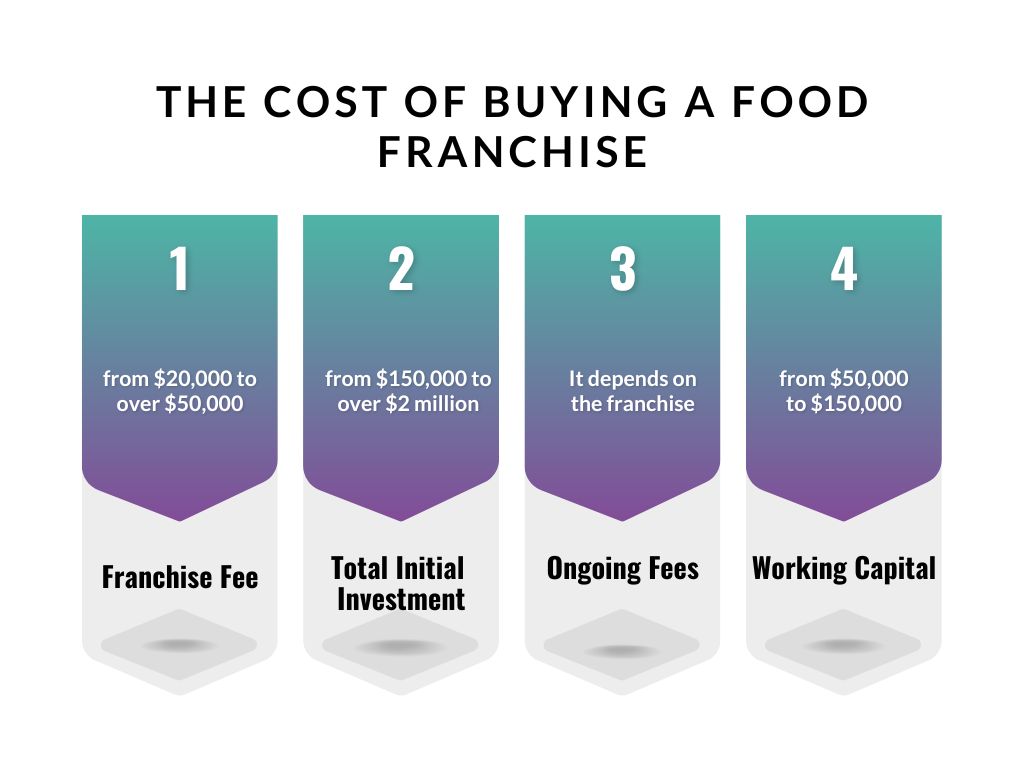

The Cost of Buying a Food Franchise

Â

Â

Before jumping into financing, it’s important to understand the full range of costs involved in purchasing a franchise. Franchises come with various expenses, from the initial franchise fee to ongoing operational costs. Here’s a breakdown:

- Franchise Fee: This is the upfront fee you pay to the franchisor for the right to operate under their brand and use their business model. Franchise fees can range from $20,000 to over $50,000 depending on the brand.

- Total Initial Investment: This includes costs for equipment, real estate, marketing, and working capital. The total initial investment varies widely by brand, ranging from $150,000 to over $2 million, depending on the type of food franchise.

- Ongoing Fees: Most franchises require ongoing royalties and marketing fees, often a percentage of your sales. For instance, McDonald’s charges a royalty fee of 4% of gross sales and an additional 4% for advertising.

- Working Capital: It’s crucial to have enough working capital to cover day-to-day expenses until the franchise becomes profitable. Many franchisors recommend having at least three to six months of operating expenses on hand, which can range from $50,000 to $150,000, depending on the size and scope of the business.

Given these costs, financing the purchase of a food franchise often requires a mix of personal savings, loans, and other creative financing solutions. Let’s dive into the different options.

-

Personal Savings

Starting with your own savings is one of the simplest ways to finance your food franchise. If you’ve built up enough capital, using personal savings can help you avoid taking on debt or giving up equity in your business.

Pros:

- No Debt: You won’t have to worry about loan repayments or interest.

- Full Ownership: You maintain complete control over your business without having to share profits or decision-making power with investors.

Cons:

- Risk: Investing your personal savings into a franchise can be risky. If the business doesn’t succeed, you could lose your entire investment.

- Limited Capital: Most entrepreneurs don’t have enough savings to fully fund the purchase of a franchise, especially when the total initial investment can exceed $500,000.

-

Traditional Bank Loans

Traditional bank loans are one of the most common financing options for aspiring franchisees. Many banks are familiar with the franchise business model and offer term loans for qualified borrowers.

What to Expect:

- Loan Amounts: Depending on the lender and your qualifications, you can borrow anywhere from $100,000 to several million dollars.

- Interest Rates: Interest rates for business loans typically range from 6% to 12%, depending on your credit score, the loan amount, and market conditions.

- Repayment Terms: Terms usually range from 5 to 10 years.

Pros:

- Access to Large Sums: Bank loans can provide the capital needed for large franchise purchases.

- Familiar Process: Banks are accustomed to working with franchisees and may even have specific franchise loan programs.

Cons:

- Collateral Required: Most banks require collateral, such as real estate or personal assets, to secure the loan. If the business fails, you could lose your collateral.

- Strict Requirements: Traditional bank loans have stringent credit and income requirements, which may make it difficult for some aspiring franchisees to qualify.

-

Small Business Administration (SBA) Loans

SBA loans are a popular option for franchise financing. These loans are partially guaranteed by the government, reducing the risk for lenders and allowing borrowers to access lower interest rates and longer repayment terms.

Types of SBA Loans:

- SBA 7(a) Loan: The most common SBA loan for franchisees. You can borrow up to $5 million with terms up to 10 years for working capital or 25 years for real estate.

- SBA 504 Loan: This loan is geared toward purchasing real estate or equipment. It offers larger loan amounts (up to $5.5 million) and long-term repayment options.

Pros:

- Lower Interest Rates: SBA loans typically offer lower interest rates (around 5% to 8%) compared to traditional loans.

- Longer Repayment Terms: Repayment terms can stretch up to 25 years, making monthly payments more manageable.

- Accessible for Franchisees: SBA loans are specifically designed for small businesses, including franchises.

Cons:

- Lengthy Approval Process: The SBA loan process can take several months, as it requires significant paperwork and approval from both the SBA and the lender.

- Collateral and Personal Guarantee: Similar to bank loans, SBA loans require collateral, and the borrower must personally guarantee the loan.

Statistics:

- According to the SBA, in 2022, over $36 billion in loans were distributed through the 7(a)-loan program, and franchises received a significant share of those funds.

Here are some extra sources that can offer valuable insights into how franchises operate in Toronto. By utilizing the information acquired from these sources, you can confidently begin your journey toward becoming a prosperous franchise owner. These resources provide various viewpoints and can assist you in navigating the realm of franchising with assurance and proficiency.

- Foodie Frenzy or Franchise Fortune? Why Food Franchises are Booming (and How You Can Join!)

- A Guide to Understanding the Franchise Disclosure Document

- Step-by-Step Guide to Opening a Vietnamese Food Franchise

- Top Questions to Ask Before Purchasing a Food Franchise

Â

-

Franchisor Financing

Many franchisors offer financing options to help new franchisees cover the initial costs of purchasing a franchise. This could include direct loans, partnerships with third-party lenders, or leasing options for equipment.

Pros:

- Tailored Financing: Since these programs are designed specifically for franchisees, they often come with favorable terms and an understanding of the unique needs of the business.

- Simplified Process: Franchisors often have relationships with preferred lenders, making the approval process faster and easier.

Cons:

- Limited Flexibility: Franchisor financing may not offer the same level of flexibility as other loan options.

- Higher Interest Rates: In some cases, franchisor financing may come with higher interest rates than SBA or traditional loans.

Example:

- Fast-food giant Subway offers financing through third-party lenders, covering up to 80% of startup costs for qualified franchisees.

-

Home Equity Loans or Lines of Credit (HELOC)

For homeowners, tapping into the equity in your home is another option for financing a franchise purchase. A home equity loan allows you to borrow a lump sum based on the value of your home, while a HELOC operates more like a credit card, where you borrow as needed.

Pros:

- Lower Interest Rates: Home equity loans often offer lower interest rates compared to unsecured loans because they are secured by your home.

- Large Borrowing Capacity: You can potentially borrow a substantial amount, depending on how much equity you have in your home.

Cons:

- Risk: If the franchise fails and you’re unable to repay the loan, you could lose your home.

- Limited to Homeowners: This option is only available if you own a home and have sufficient equity built up.

-

Retirement Funds (ROBS)

In the U.S., Rollovers as Business Startups (ROBS) is a unique way to finance a franchise using retirement funds without paying early withdrawal penalties or taxes. ROBS allows you to roll over funds from a 401(k) or IRA and invest them in your business.

Pros:

- No Debt: Since you’re using your own money, you don’t have to worry about taking on debt or paying interest.

- Tax-Free: ROBS allows you to avoid the taxes and penalties associated with early withdrawals from retirement accounts.

Cons:

- Risking Retirement Savings: If the business fails, you could lose a significant portion of your retirement savings.

- Complex Setup: Setting up a ROBS plan requires careful legal and financial planning to ensure compliance with IRS regulations.

-

Partnering with Investors

If you don’t want to take on debt, partnering with investors is another way to finance your franchise. In exchange for funding, investors will typically receive equity in your business or a share of the profits.

Pros:

- No Debt: You won’t have to worry about loan repayments or interest.

- Shared Risk: Having investors means you’re not shouldering all the financial risk on your own.

Cons:

- Loss of Control: Investors may want a say in how the business is run, and you’ll likely have to share decision-making power.

- Profit Sharing: You’ll have to share a portion of your profits with your investors, reducing your overall earnings.

-

Crowdfunding

In recent years, crowdfunding has emerged as a popular way to raise money for business ventures, including franchises. Platforms like Kickstarter, GoFundMe, and Indiegogo allow you to raise money from a large group of people, typically in exchange for rewards or equity.

Pros:

- No Debt: Crowdfunding allows you to raise money without taking on debt or giving up equity.

- Build Community: Crowdfunding can help you build a loyal customer base before your franchise even opens.

Cons:

- Uncertain Results: There’s no guarantee that you’ll raise enough money through crowdfunding.

- Time-Consuming: Running a successful crowdfunding campaign requires significant time and effort, including marketing and engaging with potential backers.

Final Thoughts

Financing the purchase of a food franchise requires careful planning, research, and consideration of the available options. Whether you tap into personal savings, secure a loan, or find alternative funding through investors or retirement funds, there are multiple paths to owning your dream franchise.

Key Takeaways:

- Bank Loans and SBA Loans are among the most popular and accessible financing options for franchisees.

- Franchisor Financing may simplify the process but could come with higher interest rates.

- Home Equity Loans, ROBS, and Crowdfunding provide alternative funding routes that may suit different financial situations.

- It’s essential to have a solid business plan and a thorough understanding of your financial situation before choosing a financing option.

With the right financing, you can unlock the door to franchise ownership and set yourself on the path to entrepreneurial success. Make sure to evaluate your options carefully, consider the risks, and choose the financing solution that best aligns with your long-term goals.

The final reflections on the PHO franchise opportunity in Toronto

Running a pho franchise in Toronto offers an exciting and profitable business opportunity. The city’s diverse population, robust economy, and thriving culinary scene provide numerous chances for success. However, it’s essential to conduct thorough research to identify the most suitable franchise option and develop effective marketing strategies to stand out in this highly competitive market.

To ensure success, seek guidance from industry experts, connect with experienced franchise owners, and remain adaptable to changing consumer preferences. By capitalizing on the lucrative pho franchise opportunities in Toronto, you can establish a thriving business within the city’s dynamic food landscape.

Explore the vast opportunities awaiting you as the proud owner of a pho franchise in Toronto! Take the plunge and contact the Toronto PHO franchise team today to embark on this exhilarating and rewarding business venture.

To locate our establishments, search for “pho near me” and find us in Toronto, North York, Woodbridge, and Hamilton. We have meticulously selected these diverse locations to ensure accessibility and convenience for our esteemed customers.